AirBnb Investing

Two-and-a-half years ago I moved to a new area after taking a new job. My finances were in tatters after a divorce. I had some cash from the sale of a house, but most of my money was locked up in an IRA, and retirement was getting uncomfortably close. Airbnb investing was at best a distant dream.

Every budget I made told me I was going to barely scrape by. I knew that most divorced men with alimony payments end up renting, unable to meet the normal banking standards for taking on a loan. In this, at least, I was lucky. I could afford something.

So when I started looking at houses I kept on eye on the possibilities of somehow defraying the costs with a roommate, or a renter. I weeded out the houses where this would be impractical. It eliminates a lot of houses when you start down this path. My preference was for something with a separate apartment, where I could preserve some level of privacy. That narrowed it further.

While I did look at duplexes, most of the houses I found in this category were depressingly bland. Did I mention that I write about architecture? Aesthetics was high on my list.

I took serious looks at about 30 houses. It was that 30th house where everything clicked. It was a duplex, but stylish. The neighborhood was a delightful mix of large and small, quaint and grand. Back in the day, in this case the 1930’s, there was less class separation in housing developments. Here you could find beautiful showcase homes next to bungalows, with a scattering of apartments and duplexes.

But I digress.

I had found my home. One side was rented. The other side was ready for me. It needed some work, but it was not one that you would call a fixer-upper. Let’s just say, like a lot of rent houses, the previous owners had done just enough to get by.

The offer price was $177,000. We settled on $170,000. By the time I had fixed up both sides, replaced the gutters and some of the windows, painted it, and solved the water problem in the basement, I had $200,000 into the structure.

Now remember how I got you here. This is all about Airbnb investing. So let’s get down to business.

Starting Up My Airbnb Investment

I had travelled a lot. Enough to have grown sick of hotels.

I used to call bed and breakfast inns and negotiate a mid-week rate, but that

was hard work. When Airbnbs started to become popular I discovered a way to

avoid hotels and still get a good place to stay. So when I considered possibly

renting to others, I had the idea in the back of my mind that an Airbnb might

be a better deal. I even stayed in lots

of Airbnbs when I relocated, to get a feel for the prices I could expect to

receive and to pick up tips on how to do this.

First, I realized that the place I purchased need a serious refresh if I was going to be competitive. It took me about 6 months of evenings and weekends, but I got my place looking good. When I was ready I gave my tenants notice and moved to the other side. Did you know it is really hard to kick people out of their apartment? I don’t mean legally, although that can be. I mean emotionally. It was hard. I would have done it anyway, to do the cleaning and painting and fixing needed to get higher rents, but it was hard.

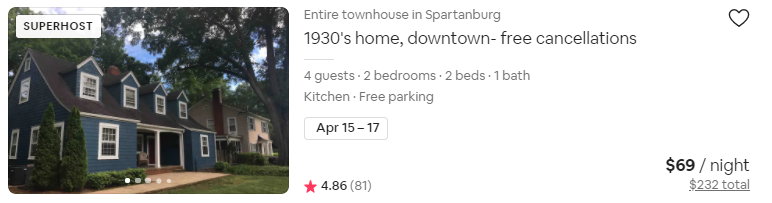

Having moved in to the second side, I now advertised the first side on Airbnb. I still had one problem. My house painter had taken a fall on another job and my painting was delayed while I waited for another guy to finish his work elsewhere. Then winter came and delayed it further. I ended up advertising with photos of a house that needed new paint, so I was very clear in my ad that it still needed new paint and I was charging less until that happened. Instinctively I felt it was wise to be honest, and it turns out the Airbnb system rewards that.

On Superhosts and Guests from Hell

Each time someone stays they get a chance to rate their stay. One to five stars is their options. In reality anything less than a five star can be damaging to your chances of success as an owner. So, if you say your house is in perfect condition and someone arrives to peeling paint, they might give you a four star rating, even if they otherwise loved their stay.

All those stars go into identifying the “Superhosts”, and the star rating is shown front-and-center when you pull up information on a house. Where would you rather stay? At a place rated a 4 or a place rated a 5? Who would you rather rent from? Someone labelled a “Superhost” or someone who doesn’t stand out from the crown? Those good ratings add up to either more nights rented, or higher room charges, or both. So…they mean money, and we are talking about Airbnb investing.

That means it is best to keep your place spotless, be truthful in your ads, and have clear communications with your guests. It is extra work, and it adds a lot of stress to the owner experience.

I had the rather unpleasant experience this year of having a guest give me a two-star rating. It takes a lot of fives to make up for a two. I have to maintain a 4.8 star rating to maintain my “Superhost” status. In this case the woman in question had never used Airbnb, had not finished the registration and background check process, and had called me up in a panic because her stay had not gone through yet. I think she showed up on my calendar, but without the transaction being completed she wasn’t getting the address, or the door code I send out. I listened to her story, decided that her stay would clear, and so I allowed her to stay with me even though the visit might not clear through Airbnb in time to get paid in the normal way.

She stayed with me several days. On the second day she was finally cleared by Airbnb, and I got paid. But here is the bad part. She left the place a mess and I had to pay my cleaning crew extra to make it presentable for the next guest. I made the mistake of following up with her to try to get the extra $25 out of her for the cleanup. Not worth it. She had not rated me yet, so when she got the chance she gave me a “2”. She moaned that I would dare to charge a cleaning fee at all, and then to ask her for more was outrageous. And, worst of all, she had a valid point in at least one regard. She claimed the towels in the cabinet smelled musty. I had not realized it, but my dryer was getting clogged and the towels were not drying in time.

What I would consider proper etiquette in a case like this is for the guest to inform the host of the problem and give them a chance to correct it. You might drop their rating to a “4” and make some public comment if you felt that the owner had not addressed the problem. Okay, that is me. I can’t expect my guests to think the same way that I do, and I can’t expect new guests to be savvy in the way that Airbnb works. She was new. She gave me a ridiculously low rating, and I made the mistake of seeking compensation when I knew she had this cudgel she could yield.

And that is one of the drawbacks of hosting. Every year you will have dozens of opportunities to have your day ruined. Or, if you are sensitive, your week or your month ruined.

Now Airbnb investing can be done at arm’s length. You use a management company and they handle that. If you are talking about vacation rentals in a resort environment that is a common way to go. If that is your market then Airbnb didn’t change the market much. You could have done that in 1980. What Airbnb opens up is the short-term rental market everywhere else, and in many of those markets property managers aren’t a viable option. So for most people Airbnb investing requires settling into the grungy details of keeping your guests happy.

So, back to my story. They give you the Superhost rating after you have a certain number of rentals and a certain number of ratings and if those ratings exceed 4.8 stars, but they only do their accounting for this every few months. So it took me several months to achieve that status. I recall those being months of anxiety.

I cannot say the exact benefit gained from being a Superhost. It surely helps. Maybe the biggest advantage is that it keeps me on my toes. I am more ready to engage my guests because I know they can be a great source of advertising. Their stars and their comments will be seen by others, and that can make a difference.

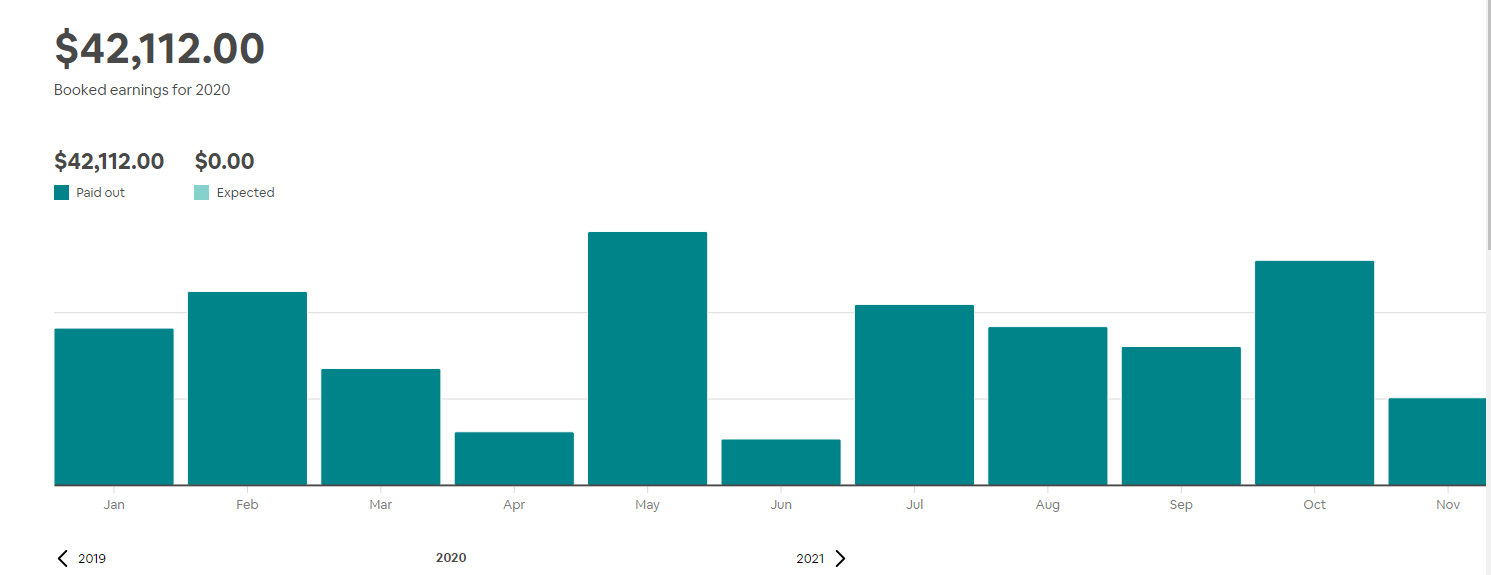

When I bought my place the one side was renting for $800 a month. The other side was smaller, so probably it would have rented for something like $700 a month. The owner thought I could get $1000 and $800 for the two sides, but that was just a guess. Last year I grossed $42,000 from renting out both sides. Yes. In 2020, the Covid year. That is about twice as much as the rents I could have received. But, subtracting utilities and internet, cleaning costs, and maintenance, I made about $1,000 a month in total. And I think that is about $700 a month more than I would have gotten from rents.

Conversely, had I traditional renters, and their income had dried up from Covid, I would not have been able to evict them. In my case I came out well ahead as an Airbnb investor.

To get the Airbnb income, I had to invest in furniture. How much that will add up to depends a lot on the type of place you are renting. These were middle-class furnishings, so lets just say I invested several thousand dollars in order to gain that extra $700 a month, and I had to invest a lot more time. Does it still look like it was worth it?

In the Year of the Covid, I still did fairly well.

In the Year of the Covid, I still did fairly well.Covid and Airbnb Investors

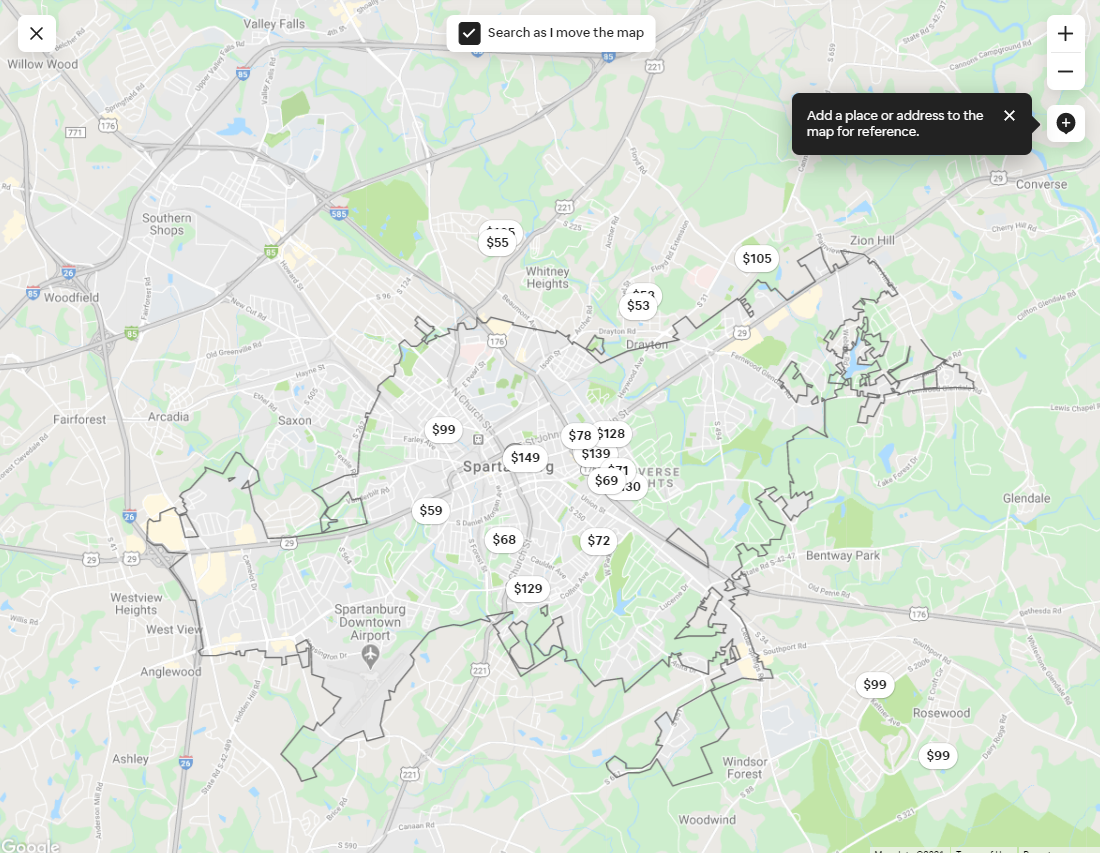

Here is another way to consider the economics of the case. When I started renting my place on Airbnb I kept a spreadsheet of all the competitor listings. I would update the prices periodically. And I would check on their availability for the next 30 days. It was my way to see if I was charging too much or too little. There were about 30 houses in roughly a 20 mile radius. Most were close in, because my house is close to downtown Spartanburg. I maintained that list for several months, and then I dropped it. About two months ago I started looking at the Spartanburg listings again. Of those 30 I could only find 4 or 5 that still were listed. Others had taken their place, but, that tells me that quite a few hosts decided it was not worth their time to continue as Airbnb investors. As for me, I have enjoyed the experience, but I am thinking that many others have not.

Last year was a Covid year. The stresses were greater. It really hit the room rental part of Airbnb the hardest. Who wants a stranger in the house with them? Who wants a different stranger in the house with them every week?

Still, in my case, renting out a whole apartment, I don’t think it hurt that much. March and April were close to empty, but when people started travelling the Airbnb option sounded safer than hotels. You can really self-isolate in an Airbnb. Not so much in a hotel.

Another change in the market - When I started there were two other Airbnbs in my neighborhood. Now there are about six.

Another change in the market - When I started there were two other Airbnbs in my neighborhood. Now there are about six.Airbnb Room Rates

When I initially moved to Spartanburg, as I was considering the Airbnb market, if looked like I would be able to get $100 a night. By the time I was ready to accept a guest, six months later, I discovered I could really only get in the $60 to $75 range. Had I misread the market?

I think what happened was a case of supply catching up to demand. As people heard about their friends getting a $100 a night, they entered the market. Then there were more houses than guests and prices dropped. Expect that to happen. Airbnb is growing. More and more people are travelling that way each year, but as you get more and more Airbnb travelers you will also get more and more Airbnb investors. Expect an ebb-and-flow as supply and demand jockey to find the equilibrium in the middle.

Another surprising thing I noticed is that the Airbnb market tracks lower than the hotel market. If a hotel suite with one bedroom gets $150 a night, expect a similar Airbnb to get something like $120 or $100. It doesn’t make sense when you look at how much you get. If someone rents my place they get more area, two bedrooms, a full kitchen, and a washer and dryer, so I should get more than what the hotel is charging. I expect that to change over time, but for now, in my market, that is the reality.

Also, the Airbnb rates are sometimes at odds with the cost of housing. A house in San Francisco might cost five times more than a house in Spartanburg. You might expect the Airbnbs to command a price five times higher. In reality they are only about half-again as costly as Spartanburg Airbnb rates, while rents probably are five times as much.

Here is what I think is happening. If you own a house in Spartanburg you don’t need to sublet a room or a garage apartment to make ends meet. In San Francisco you probably do. So there are a lot more people trying to find a way to rent out a room, and Airbnb is an attractive option. That increases the supply relative to demand. But it still doesn’t explain why rents and Airbnb rates don’t track.

AirBnb Investor Redux

So far I have talked about my experience with my duplex in Spartanburg. It is the next story that might be illuminating if you are considering becoming an Airbnb investor and not just someone trying to fill some empty rooms.

Life necessitated a change in jobs. I made the decision to rent out both sides of my house even though I did not yet know where I was going to be. Great decision. Starting in January of 2020 I had both sides renting, which gives me, a year later, a year of profit on my house as I try to finance a home in Virginia. That profit shows up on my taxes. That is critical, because for any kind of traditional, FHA or VA loan, the banks don’t care what kind of profit-and-loss statement you can show them. They care what you report to the IRS. So a couple of months ago they were willing to lend me a lot less than they will now, because now I have a 2020 tax return.

If, as an Airbnb investor, you are using a commercial loan, the rules are different. Using a commercial loan you probably can get a loan without having to have it validated with a tax return.

Of course I could have sold the house in South Carolina. Then I would not have had an issue buying in 2020. But remember when I said retirement was looming? Airbnb investments are part of my solution. So now that I have a property making income, I don’t care to give it up. Likewise, as I succeeded with the Airbnb once, why not twice? So here I am, trying to own two Airbnb properties, and considering how I can extend this out so that my retirement poverty will be comfortable and not abject.

I met a man once who was managing his Airbnb property from a distance. He gave me some advice. He shared an app he used that listed multiple repairmen, and he was disciplined in his communications with his guests, so they had a personal connection to them. This kept his ratings high and allowed him to handle the crisis of the day.

I took a slightly different approach. I advertised in the “Neighbors” app and found a guy who is mechanically savvy, and friendly, and he picks up my mail, takes the trash cans to the curb, and is available when a pipe breaks. He also does a fair share of the cleaning. For him he is making good money for this second job. For me, I have someone reliable who is close.

Of course, being at a distance costs me. Nothing is free. And I have the anxiety of not being there when things are going wrong. Yet, despite that, I am able to keep up through my local handy man, and I still have the direct communication with the guests to let me know the status of my house.

Homestays and AirBnb Investing

Back to my current house search. I discovered shortly after arriving here, that not all was like it was in South Carolina. I had been lucky. Spartanburg had no special short-term rental regulations, and my house had been designed for renters from its beginning. Here many of the municipalities have regulations that are restrictive, and that has made my search…interesting.

For instance, I wanted to buy a house in the country-side, add a bathroom and a wall and rent out the one part as an Airbnb. I discovered that I could do the division and rent it out as an apartment because I was on more than two acres, but I needed five acres for a short-term rental, and I was short of that amount.

I considered a house in Lexington, Va. That city has a limit on the number of days you can rent out a room or an apartment. I think it was 114 days. Harrisonburg, by comparison, limits homeowners to 90 days.

Then I found a place across the river, in Rockbridge county. Beautiful place. Truly a dream house. It was zoned R-1, and the rule for that classification is it had to be owner-occupied and available for occasional renters. I wouldn’t be able to leave it and still continue the Airbnb, like I did in South Carolina, and I would have to worry about when I had passed the “occasional” line. Further complicating this dream house was the need to go before the Zoning board and ask for permission to operate an Airbnb.

I looked at the minutes of past board meetings. I found several instances where people had applied to have “homestays”. In most cases permission was granted, but they always added on conditions. They seemed to be concerned that the owner be present when there were guests. I decided that there was too much risk that I would end up in a house that I would not be able to rent out, and my retirement would be a lot less comfortable.

I have looked at the zoning rules in about 12 municipalities surrounding my place of employment. Here is what I discovered.

Many have some kind of allowance for a “homestay” or a similarly-worded designation for a short-term rental. This is designed to allow a homeowner to rent out a room without getting into legal trouble. A couple of these places are college towns and they can get ridiculous rates on about 10 weekends a year, during graduations or home football games or big alumni weekends. Sometimes that designation is too restrictive to use if you are planning an Airbnb business. One regulation I read even states that you are only allowed to have one guest per room. What?

There is usually one or several classifications that are less restrictive. These might be “Tourist Home”, “Bed and Breakfast Inn”, “Country Inn”, “Boarding House”. A lot of them seem to get hung up on meals. “Shall serve breakfast”. “May not serve meals to non-guests”. Somewhere in there you can find a way of turning a house into an Airbnb rental, but these classifications are usually restricted to commercial zones, or high-density residential zones. Chances are, the perfect house you found isn’t in the right zone.

Then there is the split between whether no permission is needed, permission is needed but you just fill out a form, or permission is needed after notifying neighbors and having a hearing before a board.

I have found some houses to be zoned commercial when you would not expect it. That usually works out well for you, but if there is a restriction against having a residence in that zone it may prevent you from using traditional homeowner financing. That has kept me from at least one opportunity.

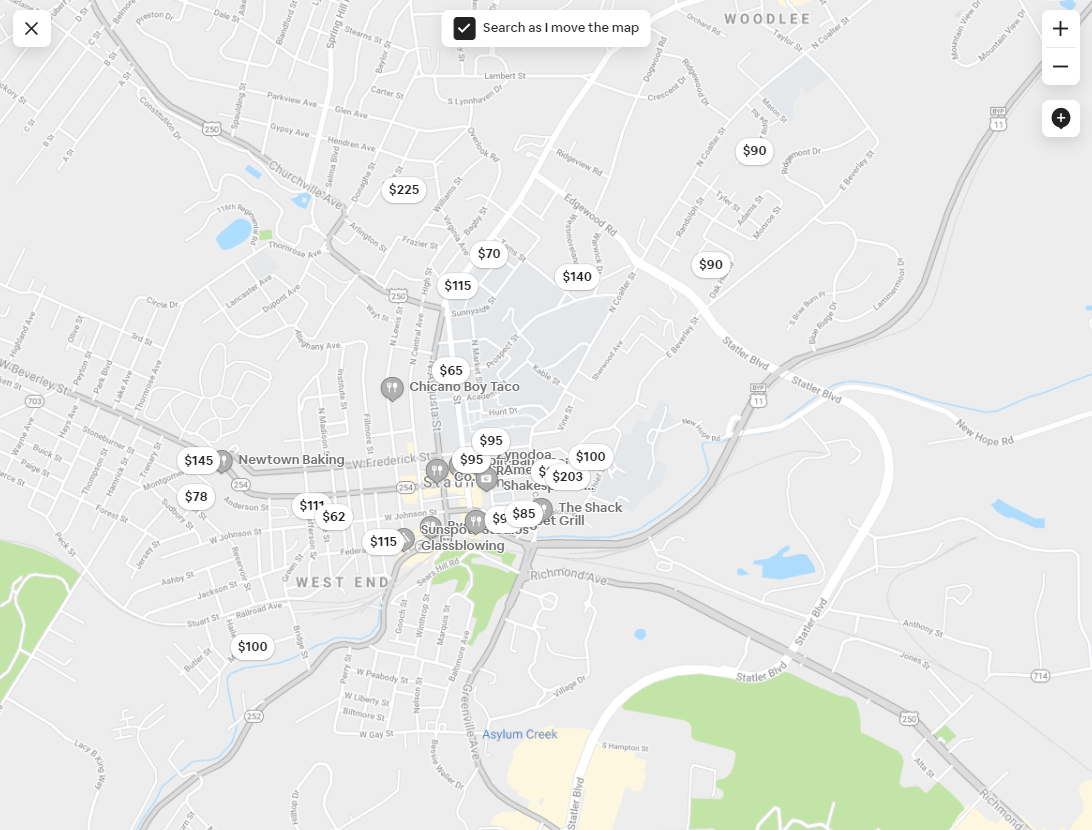

Luckily, the city closest to my work is Staunton, Virginia. It happens to have the most liberal Airbnb terms of any of the jurisdictions within a commuting distance. While they are quite concerned about parking spaces if you add an apartment, they forego that restriction for homestays. They also have no requirement that the owner reside on the property. That is the plus side.

The downside is that this has encouraged more Airbnb rental units to come into being. That means more supply and lower prices. Still, it is a net gain for me, as this greatly reduces the risk. I don’t have to worry about some neighbor ratting me out. Of course I still have to worry about noisy guests and such, but I will be operating legally.

My Next House - Maybe

As I write this article, I am waiting for a response from an offer I made on a house. There are two I am considering that will not break my budget, and one that will require me finding an extra $100,000 for a phase 2 construction project. All require some level of construction or rehabilitation. One of those projects I could probably handle myself, both the financing and the work, but the others require professionals and lots of money.

Two of those will provide some level of income even before the rehabilitation begins. One will not see a cent for close to a year. Depending on the house and how much construction I will do, I will end up with somewhere between two and four Airbnb units. I will live in one, at least for a while. It if works out, I may replicate this again.

At this point I am excited. After months of searching I can finally have some certainty, and I can once again lay my head to rest in a place I call my own.

My Final Words on AirBnb Investing

Now, back to the subject of this article. Airbnb

investing.

In my case I am using my VA benefits for the purchase and rehabilitation of the house. That is zero down. I don’t have to touch my retirement money for that. If things work out, when I finally leave this house it will provide between $15,000 and $20,000 a year in income. While still residing there it will be a little less, but either way I will be doing considerably better than if I was just buying a house and not gaining income.

For me to replicate this I will have to come up with cash for a down payment, and probably that would have to come from my IRA. So then it becomes an investment decision. Do I make more money leaving the IRA money invested in stocks, or do I pull some and use it for an Airbnb investment? Or do I find a way of investing in Airbnbs through my IRA?

I can’t say for sure which is better. But in a few months I will better know how much money I can expect to make in this market. I will have better information than I currently have. If all goes as I hope, then it would make sense to use some of that IRA to invest in another Airbnb property. It certainly adds to the risk, leveraging myself, but not without attendant rewards. If a $100,000 from my IRA gets me $20.000 a year in income that is far better than I can expect to see from the stock market.

There is one other thing to consider. I really like this. Buying a house. Painting the rooms. Making creative decisions. Seeing the money come in. Mostly, it is a lot of fun. It is also work, and if I did not enjoy it, the money would probably not be worth it.

I know this can be done. I quite often see Airbnb listings where the host has multiple Airbnbs. These individuals have found a way of making it profitable and managing the work load. Some of these are real estate professionals. This can give them some advantages, but it also gives them insight into the market. If they think an Airbnb investment is wise, perhaps you should also.

One last word of advice. One of these professionals explained their Airbnb journey to me. They had previously owned several houses where they rented out the entire house as an Airbnb. Over time they had gotten rid of those units and were focusing on places where they would have multiple units in a building. That may not hold true or practical in all markets, but it is guiding my strategy as figure out how to do this.

Here is a map of the AirBnb listings available on February 14, 2021

Here is a map of the AirBnb listings available on February 14, 2021

Please!

New! Comments

Have your say about what you just read! Leave me a comment in the box below.